Maximizing Profit Potential in Forex Trading: Strategies for Growth

Forex trading, also called international change trading or currency trading, is the world wide marketplace for getting and selling currencies. It runs 24 hours a day, five days a week, allowing traders to participate in the market from everywhere in the world. The primary aim of forex trading would be to profit from variations in currency exchange charges by speculating on whether a currency set will increase or drop in value. Players in the forex industry contain banks, financial institutions, corporations, governments, and specific traders.

Among the crucial features of forex trading is their large liquidity, and thus large sizes of currency can be bought and bought without considerably affecting trade rates. This liquidity assures that traders may enter and quit jobs rapidly, permitting them to make the most of even small cost movements. Furthermore, the forex market is very accessible, with low barriers to entry, enabling individuals to begin trading with somewhat small amounts of capital.

Forex trading provides a wide range of currency pairs to trade, including significant pairs such as for instance EUR/USD, GBP/USD, and USD/JPY, in addition to modest and amazing pairs. Each currency couple represents the change rate between two currencies, with the first currency in the couple being the beds base currency and the 2nd currency being the offer currency. Traders can benefit from equally rising and slipping markets by taking long (buy) or small (sell) jobs on currency pairs.

Effective forex trading takes a solid understanding of simple and specialized analysis. Simple examination involves analyzing economic signs, such as interest rates, inflation charges, and GDP growth, to gauge the main strength of a country’s economy and its currency. Technical evaluation, on the other give, requires studying value maps and patterns to recognize traits and possible trading opportunities.

Chance management is also essential in forex trading to safeguard against potential losses. Traders often use stop-loss purchases to limit their downside chance and employ proper place size to ensure that no single deal can considerably impact their over all trading capital. Furthermore, maintaining a disciplined trading method and preventing feelings such as for example greed and anxiety are important for long-term success in forex trading.

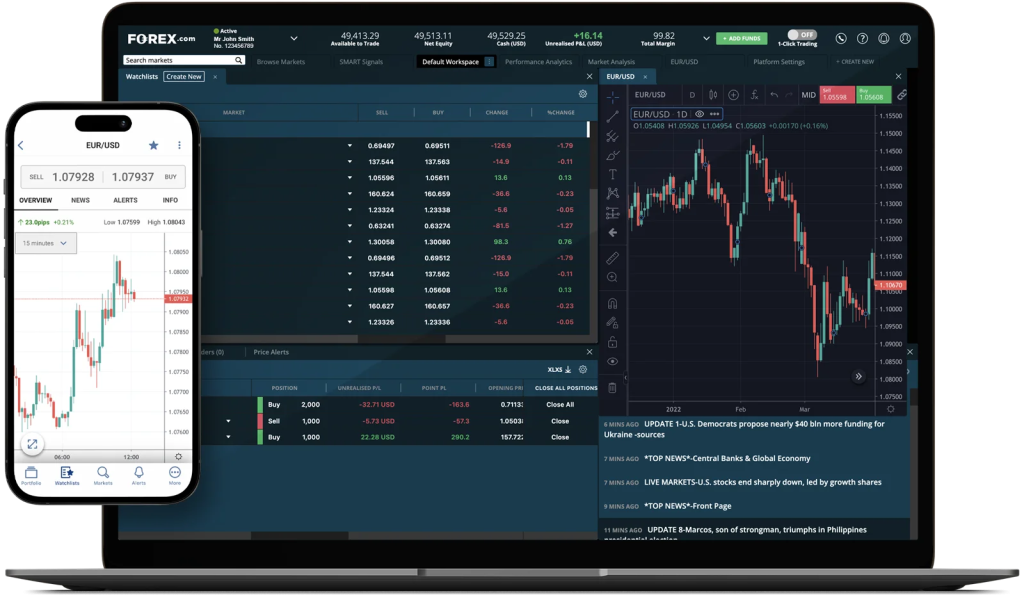

With the advancement of technology, forex trading has be much more accessible than ever before. Online trading tools and portable programs provide traders with real-time usage of the forex market, permitting them to execute trades, analyze industry data, and manage their portfolios from any device. More over, the accessibility to instructional forex robot assets, including tutorials, webinars, and demo accounts, empowers traders to produce their skills and enhance their trading efficiency over time.

While forex trading offers significant revenue possible, in addition it bears inherent risks, such as the possibility of substantial losses. Thus, it’s essential for traders to conduct complete study, create a sound trading technique, and constantly check market conditions to produce informed trading decisions. By staying with disciplined chance management techniques and remaining knowledgeable about international financial developments, traders may enhance their likelihood of accomplishment in the powerful and ever-evolving forex market.