Forex Trading Strategies That Work: Proven Methods for Profitability

Forex trading, also known as international exchange trading, requires the buying and offering of currencies on the foreign trade industry with the goal of creating a profit. It’s the largest financial industry globally, with an average everyday trading size exceeding $6 trillion. Forex trading offers investors and traders the chance to suppose on the fluctuation of currency rates, letting them perhaps make money from improvements as a swap rates between different currencies.

One of many key top features of forex trading is their decentralized character, since it works 24 hours each day, five times a week across different time areas worldwide. This availability enables traders to participate on the market at any time, providing sufficient options for trading round the clock. Also, the forex industry is extremely fluid, meaning that currencies can be purchased and distributed quickly and simply without significantly affecting their prices.

Forex trading involves the utilization of power, which allows traders to manage greater positions with a lot less of capital. While leverage can improve profits, in addition, it increases the danger of failures, as also little changes in currency prices can result in significant increases or losses. Thus, it’s needed for traders to manage their chance carefully and use suitable chance management strategies, such as placing stop-loss purchases and diversifying their trading portfolio.

More over, forex trading provides a wide range of trading methods and practices, including technical examination, essential analysis, and sentiment analysis. Complex analysis involves understanding historical cost data and applying various indications and chart designs to identify styles and anticipate future value movements. Essential analysis, on the other give, is targeted on examining financial signals, news events, and geopolitical developments to gauge the intrinsic value of currencies. Belief analysis involves considering industry belief and investor behavior to foresee shifts in industry sentiment.

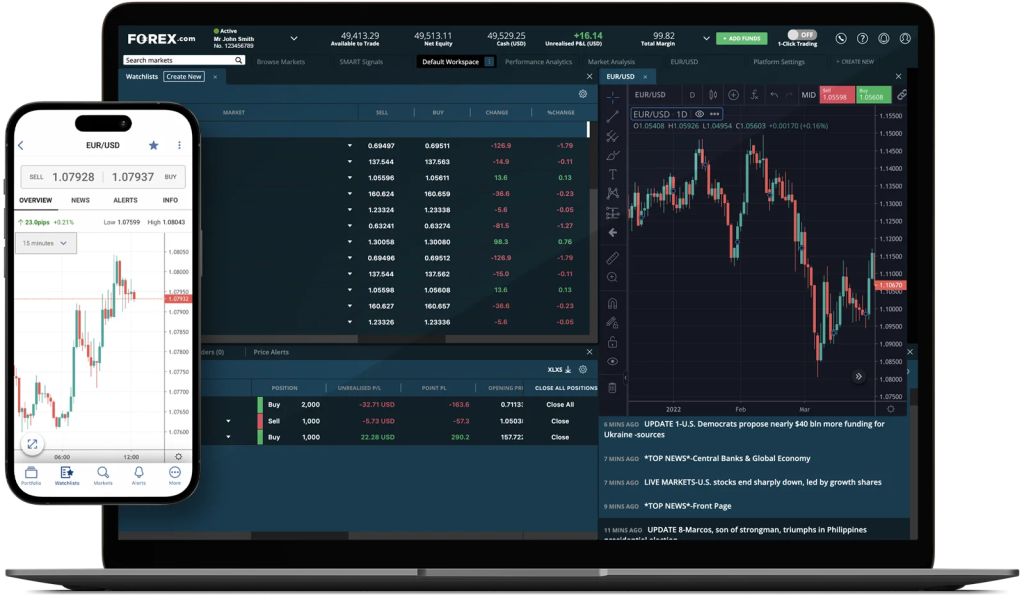

Moreover, developments in technology have transformed the landscape of forex trading, rendering it more available and efficient than ever before. On line trading programs and cellular apps let traders to implement trades, accessibility real-time industry data, and check their positions from anywhere with a web connection. Moreover, automated trading systems, such as for instance expert advisors (EAs) and trading robots, can implement trades quickly based on pre-defined criteria, eliminating the need for handbook intervention.

Despite their prospect of income, forex trading bears natural risks, and traders must be aware of the pitfalls and problems related to the market. Volatility, geopolitical functions, and sudden market actions can lead to significant deficits, and traders should forex robot anticipate to handle these risks accordingly. Additionally, cons and fraudulent activities are prevalent in the forex industry, and traders should exercise caution whenever choosing a broker or expense firm.

In summary, forex trading provides a powerful and possibly lucrative chance for investors and traders to take part in the global currency markets. Having its decentralized character, high liquidity, and convenience, forex trading is becoming increasingly common among individuals seeking to diversify their investment collection and capitalize on currency value movements. Nevertheless, it’s required for traders to train themselves about the market, create a solid trading strategy, and practice disciplined risk administration to achieve forex trading within the extended term.